“Who will be the merchant for our services? Do we have to settle all funds to RPP Account?” — this is one of most common question, I have been asked.

In this story, we will discuss answer to above question, in detail, to make things clear specially from payment gateway’s perspective.

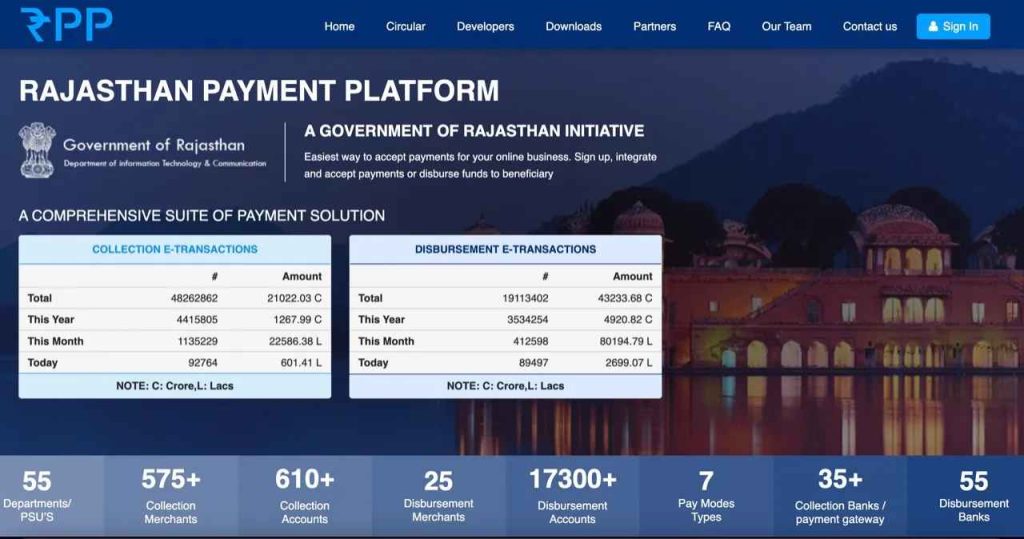

Rajasthan Payment Platform is basically a “Routing Engine” for routing of e-Payments between portals of different departments of State to the Payment Gateway and in response, return payment status back to department’s portal.

Rajasthan Payment Platform (aka RPP) is not a merchant of Payment Gateway. It’s just a system where all technical integrations will happen between Department’s Portal, RPP and Payment Gateway service providers. Also, RPP don’t have any bank account where funds will get credited after completion of transaction.

Payment Gateway Service Providers need to onboards the actual end-user department, whose portal is used by citizen for initiating payments. As soon as payment request reaches RPP, it redirects the user’s request to the respective payment gateway (as selected by user). For all onboarding purpose, payment gateway team need to map real bank account of the respective user-department at their end so that all funds settle in the account of department who initiated the transactions. For sake of simplicity, RPP system is there for routing the request and monitoring the transactions.

On Rajasthan Payment Platform, Payment Gateway service providers get an opportunity to onboard multiple departments and issue their respective MID’s. The real users or merchants for Payment Gateway Services providers will be –

- First Merchant — e-Mitra Project: One and only platform for delivery of 500+ G2C & B2C services of Rajasthan State Government, through a network of 85,000+ human-operated kiosk, 15000+ self-service kiosk and e-Mitra portal & e-Mitra mobile app.

- Autonomous bodies of State Governments having banking operations (other than treasury) like Electricity board, Pollution Control Board, Local Bodies (Nagar Nigam, Nagar Palika), Development Authorities etc.

- Government Departments operating bank accounts (other than treasury)

- Private partners having partnership with DOIT&C/RISL.

- Start-up’s registered in iStart program of state (iStart Rajasthan is a flagship initiative by the Rajasthan government for start-ups in Rajasthan)

So, I think now it is clear that as soon as a payment gateway service provider offers its services through Rajasthan Payment Platform, they directly get an opportunity to use same agreement & integration to offer their services to multiple departments / users in Rajasthan State without any additional effort.

More Possibilities for Payment Gateway’s: In general, payment gateway team approaches different types of organizations like Schools, Factories, Hospitals, Industries etc., to offer their payment gateway products. If required, Payment Gateway team can work with RPP in Rajasthan to explore opportunities of onboarding these bodies (merchant’s) through Rajasthan Payment Platform. This way, RPP system can be used to enable digital payments for all sectors of business working in state and that’s also in fast and easy way.