As a part of e-Governance activity, almost all government departments are working towards common goal of building websites/applications for transforming ‘Manual Service Delivery Process’ to “Online Service Delivery Process”. One important aspect of online service delivery process is to collect online fees against service through most commonly available mode of payments like net banking, credit card, debit card, UPI, NEFT/RTGS etc.

To facilitate online payment facility to their citizens in availing services on their website/application, departments need to undergo the extensive process of selection of payment gateway partners (generally through RFP), selection of L1 (Lowest quote first), signing of agreements with them and finally doing technical integrations to get things onboard. This L1 service provider can deliver services maximum up to period agreed in RFP (most commonly 5 years). Then again after expiry of agreement, same processes need to be repeated which is very clumsy and need domain expertise, which is again hard to find in public bodies.

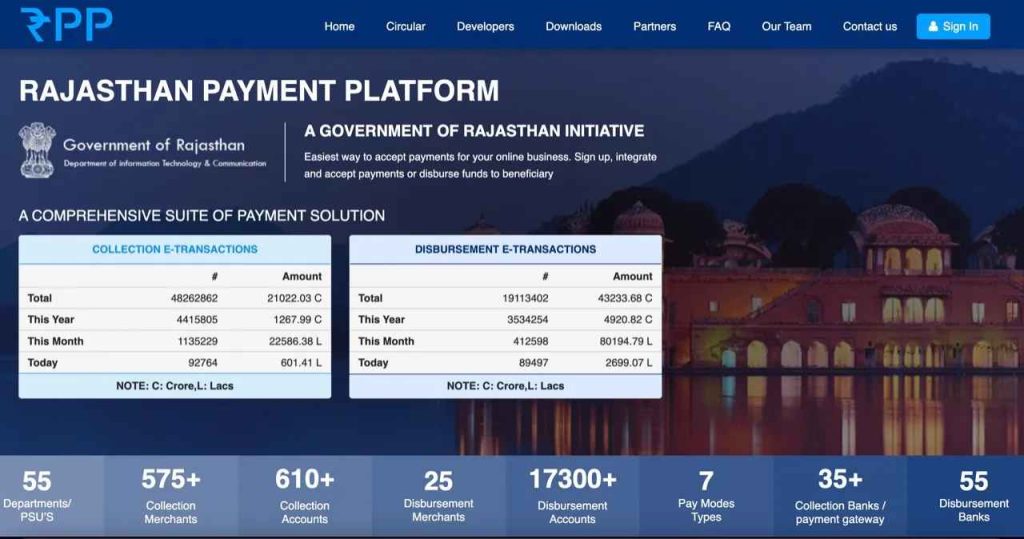

In year 2016, one more step towards compliance with the e-Governance vision of the State of Rajasthan, Department of Information Technology & Communication developed a common platform named — Rajasthan Payment Platform, to take care all payments (other than treasury) and disbursement needs of Government Departments and PSU’s under the aegis of Government. RPP was made live in Dec 2016. (Read more: Rajasthan Payment Platform — An Overview)

The Primary Objective of RPP is to bring services of all banks and payment gateway services providers on a common platform and extend them in a unified manner to the end-user departments for seamless collection and disbursement of funds through their online systems.

Under Rajasthan Payment Platform, departments are facilitated in following categories/terms–

Agreement/MoU:

- DoIT&C/RISL will sign the Agreement with banks/payment gateways for Payment Gateway / Banking services through its platform. No department need to sign a separate agreement with any aggregator/bank. Signing of contract, at central level will facilitate NIL or Lowest Convenience Fee(s) (to be paid by citizens or concerned department). With central negotiation on convenience fees charged by payment gateways/banks, any lowering of charges will be applied to all department using RPP platform.

- Department need to sign a Memorandum of Understanding (MoU) with DoIT&C/RISL to define and agree over role & responsibilities of all the parties involved in the process.

Technical Integration:

- Just single Plug and play, REST API’s based standardized payment gateway and disbursement solution with sample integration KIT in all commonly used technologies.

- The department will do one-time single integration with Rajasthan Payment Platform for payment gateway services. Single integration will suffice all future needs of department without any worry of number of services to be delivered, collection of funds in different bank accounts or disbursement of funds from different bank accounts etc.

Settlements:

- The funds collected against the services of the department will be credited directly to their Account as per the terms and conditions specified in the MoU.

- In general, all Banks/Payment Gateway’s settle funds on T+1 basis to the designated bank account of department

Support:

- Centralized technical support from RPP side to implement the solution in different technologies like Java, .Net, PHP, etc.

- Centralized functional support from RPP team to handle routine issues.

- Centralized fund Reconciliation support from domain expert team of RPP.

Special features:

- Detailed Analytics & MIS reporting via RPP dashboard and Portals of bank/aggregator.

- Disbursement facility from more than 55 banks at ZERO additional cost for NEFT/RTGS

- Collection facilities from available Payment Gateway service providers at lowest or nil convenience fees model

Finally: Both collection and disbursement services, to a single department, can be powered by multiple banks & payment gateways without any additional coding/configuration at departmental website/web-application. All additions, updations and configurations are done just at the level of RPP, and it’s done. After configuration at RPP, new payment modes or banks will be made available to the users of respective department in a realtime fashion. It’s so simple.

Conclusion: Using payment gateway services of RPP is a win-win situation for PSU’s and Departments of Rajasthan in bringing their services online for the betterment of citizens of Rajasthan.