Many times departments approach us and ask “Why we should use Collection Services under RPP instead of getting PG services directly from Bank or Payment Gateway service provider”. In this article we are going to discuss this in detail along with other key benefits that departments get over direct integration with other payment gateway service provider.

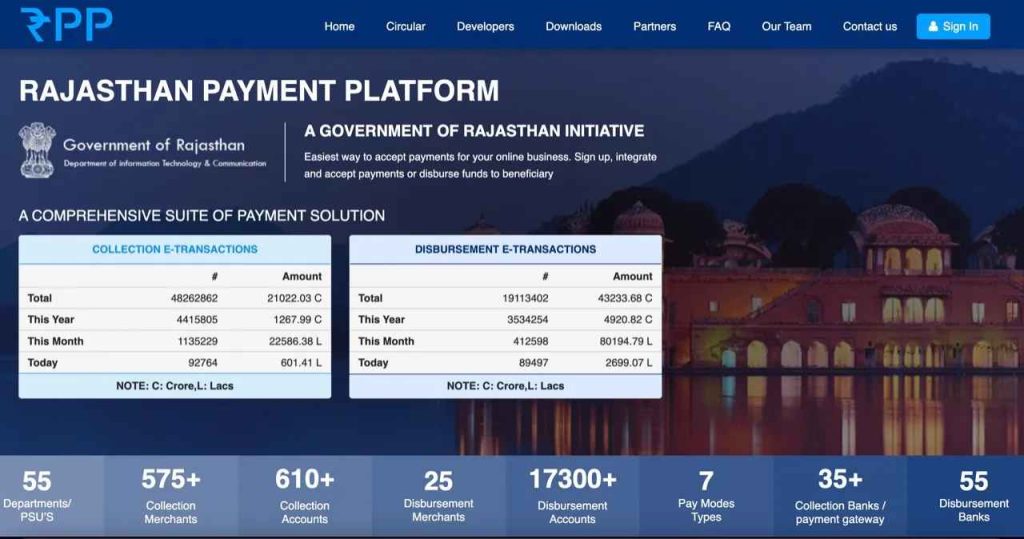

As stated in my earlier articles, the aim of establishing Rajasthan Payment Platform is to have a common platform to take care all banking (collections and disbursements) needs of Government Departments and PSU’s under the aegis of State Government. RPP brings services of all banks and payment gateway services providers on a common channel and extend them in a unified manner to the end-user departments for seamless collection and disbursement of funds through their online systems.

Now back to our original question — “Why RPP?”. Generally, banks and Payment Gateway service providers approaches departments to offer their services and in turn they want all funds to be collected in particular bank account (which may sometime needs opening of new account also). During this offering, some Bank’s/PG’s also offer subsidized rates (Lower or nil MDR / Convenience fees). But before grabbing these opportunities / offers, department need to think on following questions —

- Do department have full authorization to Open New Bank Account without approval of Finance Department, GoR?

- If any “X” Bank/PG is offering this subsidize rates and same is accepted; then what will happen when some other “Y” Bank/PG also offer same rates with condition to get all collected amount in account with them. Acceptance of offer of “Y” will require opening of new account and new integration as well. However, denial of request may raise dispute of favoring particular Bank/PG only.

- If department is ready to accept offer of another Bank/PG (example — “Y” as listed in point 2), then will department accept more such offers from few more Bank’s/PG’s? Then what will be the status of integration.

- How long this agreement will go?

- What happen after agreed period? Will Bank/PG continue this subsidized offering beyond agreed period?

- Is there any limitation of withdrawal of funds from designated bank account for “T+X” days so that Bank/PG can mitigate their expenses from that fund?

- Are all settlements done on T+1 basis, as per RBI guidelines?

- Are they not violating security guidelines of RBI to have payment collection only on secured channel? (SSL enabled, Security Audit Compliance website/web-application)

I think it’s quite tough for departmental team to find answers to questions listed above. Even if department team find some answers to these question, then also, they need to comply with rules and regulations of Finance Department, Government of Rajasthan which governs “Rajasthan Payment Platform” and all departments /PSU’s under the aegis of state government.

Rajasthan Payment Platform, originally designed & developed by DoIT&C and now governed by Finance Department, offers following advantages to departments over other channels –

Agreement/MoU:

- DoIT&C/RISL will sign the Agreement with banks/payment gateways for Payment Gateway / Banking services through its platform. No department need to sign a separate agreement with any aggregator/bank.

- Signing of contract, at central level will facilitate NIL or Lowest Convenience Fee(s) (to be paid by citizens or concerned department).

- With central negotiation on convenience fees charged by payment gateways/banks, any lowering of charges will be applied to all department using RPP platform.

- Even if any Bank/PG wants to offer subsidized rates (lower or NIL MDR/Convenience fees) to particular department / entity through RPP, then RPP system will facilitate the same under same setup.

- However, department just need to sign a Memorandum of Understanding (MoU) with DoIT&C/RISL to define and agree over role & responsibilities of all the parties involved in the process.

- Single agreement will suffice all requirements of getting services from multiple banks and/or payment gateway service providers on RPP

Technical Integration:

- RPP facilitates single Plug and play, REST API’s based standardized payment gateway solution with sample integration KIT in all commonly used technologies.

- The department will do one-time single integration with Rajasthan Payment Platform for payment gateway services. Single integration will suffice all future needs of department without any worry of number of services to be delivered, collection of funds in different bank accounts etc.

- If multiple Bank/PG are willing to offer collection services to department (may or may not at subsidized rates) and in turn department is also willing to accept the same, then on technical front nothing extra is required at the department level and all configuration & activation will be done at the level of RPP only thus facilitating multiple payment options to users of that department/entity.

Settlements:

- The funds collected against the services of the department will be credited directly to the designated bank account as per the terms and conditions specified in the MoU.

- Department need not require to open new bank account for any type of collection. Only in case of offering of subsidized rates from particular bank/PG, department need to take decision on opening of new account before acceptance of offer.

- In general, all Banks/Payment Gateway’s integrated on RPP, settles funds on T+1 basis to the designated bank account of department

Support:

- Centralized technical support from RPP side to implement the solution in different technologies like Java, .Net, PHP, etc.

- Centralized functional support from RPP team to handle routine issues.

- Centralized fund Reconciliation support from domain expert team of RPP.

Compliance:

- Rajasthan Payment Platform is an integral part of IFMS 3.0 project of Finance Department, GoR. Under IFMS 3.0, FD is going to regulates collections and disbursements of all government and public sector bodies for better monitoring. RPP is designated to be used by all bodies having banking operations.

- RPP is hosted in State Data Centre with SSL and Security Audit compliances as per state IT policy thus ensuring high level of security in all financial transactions.

Conclusion: Using payment gateway services of RPP is a win-win situation for PSU’s and Departments of Rajasthan in bringing their services online for the betterment of citizens of Rajasthan. Along with this, department can easily comply the policies laid down by FD, GoR.