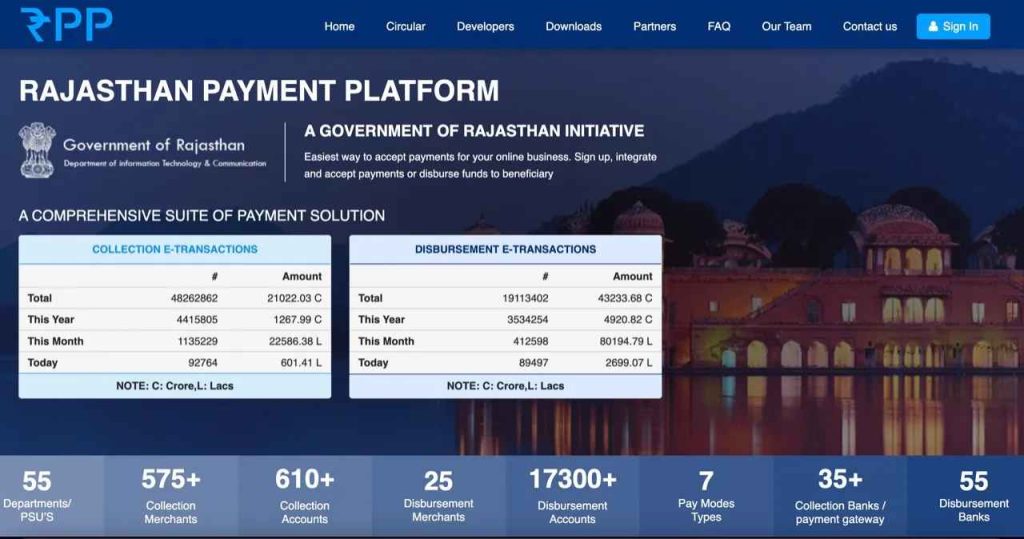

Rajasthan Payment Platform (RPP) is an e-Gateway initiative to facilitate State Government Departments & PSU’s, by providing an end-to-end digital payment solution for collection and disbursement of funds.

As discussed in my earlier stories, “Rajasthan Payment Platform — An Overview” and “Objective of establishing Rajasthan Payment Platform — The Payment Routing Engine of Rajasthan”, the various goals of launching RPP are –

- Taking Rajasthan one step forward to “Cashless Rajasthan” by proving digital banking for Departments, Citizen and Merchants.

- One-point solution for payment collection and disbursement for Rajasthan Government department, PSU’s, Corporate, Startup’s & Private organization.

- Departments /organizations need not to do separate integration or sign a separate agreement with any aggregator/banks for any services through them.

- To facilitate lowest convenience fees (or NIL) to citizens across all methods of payment (Net banking, Credit Card, Debit Card, UPI, QR etc.)

RPP offers a bouquet of services to its consumers — the Departments & PSU’s under the aegis of State Government. Services under RPP umbrella are broadly classified in two categories — Collection Services & Disbursement Services.

Collection Services: Used by department to allow citizens/users to make payments for the services offered on their websites/applications.

- Funds get credited directly in respective department’s bank-account

- Funds are settled on T+1 basis

- Modes available to users for making payment includes — Net Banking, Credit Card, Debit Card, e-Wallet, UPI, Bharat QR, ADHAAR Pay, POS.

- Option to choose from MDR or Convenience Fee Model. MDR stands for Merchant Discount Rate — Department pays the additional service charges, if any) whereas in Convenience Fee Model — Consumer pay the additional service charges, if any.

- Special Collection Services with “Single Transaction — Multiple Account Settlement” available on demand.

Disbursement: Used by departments to disburse funds to beneficiaries, vendors etc., against DBT/services rendered by them or for any other purpose, using digitally signed payment file transfer to banks.

- Departmental users need not to use any external portal (Net banking site of bank or any other portal/application of bank) for any fund remittance

- Department just required to directly Integrates REST API’s of RPP within departmental core application for seamless transfer of funds

- All payments are based on Account — IFSC combination, wherein remitted funds are transferred directly to beneficiary bank account.

- System uses private-public key combination of Aadhaar based e-Sign System of State, for encryption & validation of payment files making it fully secure.

- More than 55 Nationalized & Private sector banks are part of system

- ZERO Transactional charges for disbursement transactions through NEFT/RTGS

Rajasthan Payment Platform team is regularly working with NPCI, various other Public/Private Sector Banks and Payment Gateway Partners to extend its service bouquet to make systems more efficient and promote straight-through-process (STP) in current eco-system. Few of the upcoming services in pipeline are –

- API based TDS deposition System (Data & Money both via API)

- Bank Account Verification using NPCI System

- Aadhaar Based DBT through Sponsor Bank (NPCI)

- NEFT/RTGS Aggregator Services using Virtual Account Concept

- Bank Guarantee Validation System using API’s

Hope, in coming quarter, departments will be enabled with more services in STP mode for seamless service delivery and ease the life of departmental users and give fast and flawless service to the citizens of state.